Short Description

Excerpt

Hire payables can, for most business organisations, be defined as accounting transactions handling the invoices due/owed to Owners of vessels under a time charter contract - but is yet to be paid. All invoices are required to be paid within an established timeframe (or payment terms). As time charter contracts are set for a specific timeperiod - not voyage or voyages, the charter hire payables can span multiple vessels and voyages.

The module consists of three sections:

...

Location: Modules > Post Fixture > Hire Payable

Chapter ContentsChapters:

| Table of Contents | ||||||||

|---|---|---|---|---|---|---|---|---|

|

Long Description

...

Generate, Assemble and Post an Invoice/s

- Open the time charter (TC) contract to create an invoice for. TC contracts can be opened either directly in the Hire Payable module or via the Booking and Operations module.

- Either open a TC contract

- directly in Hire Payable:

- Go to

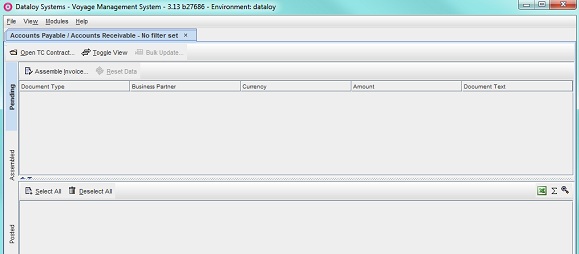

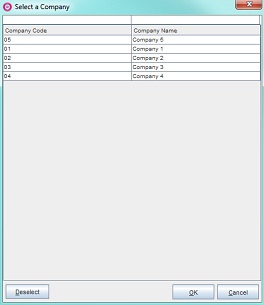

Modules > Post Fixture > Hire Payable.The Hire Payable window will openopens. - Click Open TC Contract... A pop-up with a list of TC contracts will openopens.

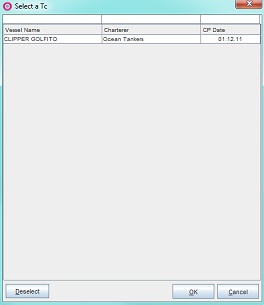

- Click selected TC contract - it will highlight.

Example: - Click OK. The pop-up will close and all pending invoice proposals associated to the opened TC contract will display - grouped by business partner and currency - in the upper field under Pending.. The bottom field displays the detailed invoice items of each pending invoice respectively.

- Go to Step 2.

- Go to

- or through Booking and Operations:

- Go to

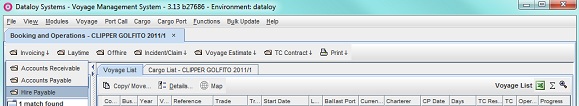

Modules > Booking and Operations > Booking and Operations.The Booking and Operations window will openopens. - Select applicable vessel in the right-hand upper field - it will highlight. The vessel's details will display displays across the screen.

- In the Voyage List, select the voyage to be opened - it will highlight.

- Go to Invoicing and from the drop-down menu select Hire Payable.

- The Hire Payable module will open opens on a separate screen displaying all pending invoice proposals associated with the opened voyage/s will display - grouped by business partner and currency - in the upper field under Pending. The bottom field displays the detailed invoice items of each proposed invoice respectively.

- Go to Step 2.

- Go to

- directly in Hire Payable:

- Either open a TC contract

In the Pending section's upper field, select the proposed invoice to assemble an invoice for - it will highlight. The bottom field will display the detailed invoice items of the proposed invoice.Anchor HIRE1 HIRE1

Example:- Review and edit (as appropriate) each invoice item, either in

- the default group view:

Example: - or click Toggle View to display the detailed invoice items in Flat View.

Note: Flat View will list all invoice items of the pending invoices listed, while the default group view will only list those belonging to one pending invoice at a time.

Example: - To filter, click the magnifying glass icon at the top-right corner. A row will display above the columns. Filter as applicable, by for example port, booking number, etc.

- Review/edit/update displayed invoice items (as appropriate) by selective or by bulk update.

Note: Only the Document Line Text, Currency, Exchange Rate Date, VAT Rate and Invoice Party fields can be edited.- Selective:

- revert the source of the invoice item data, for example, estimates, operational data, etc.

- Edit data.

- Return to the Accounts Receivable module and click Reset Data to refresh the items list.

- or click the relevant field of the invoice item to be edited- it will highlight - and edit.

Note: ALL modifications using this method to override data generated by the system will be LOST if Reset Data is at any time used after editing.

- revert the source of the invoice item data, for example, estimates, operational data, etc.

- Bulk Update:

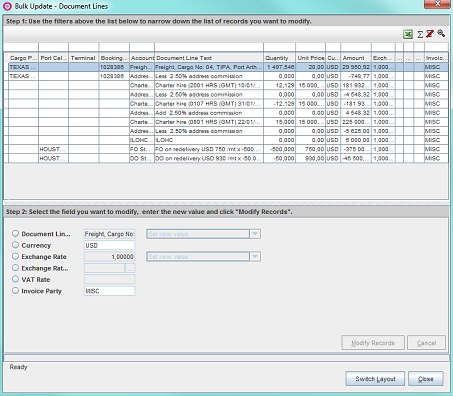

- Click Bulk Update... The Bulk Update - Document Lines dialogue box will open.

Note: Click Switch Layout to alter the dialogue box layout. Click again to revert to default layout.

Example: - In the upper field filter (as appropriate) so only the records to be edited display.

- In the lower field select the field to modify.

Note: The fields and drop-down menus are disabled by default until checked. The Modify Records button will activate once a field is checked.

Example: - Click Modify Records. The changes will apply to all bulk edited records.

- Click Close. The dialogue box will close.

- Click Bulk Update... The Bulk Update - Document Lines dialogue box will open.

- Deselect the checkbox/es of invoice items not to be included in the invoice (if any) under the Select column either in the default grouped view or in Flat View.

Note: To deselect several - click Deselect All - then filter so only relevant rows display (items to be included) and click Select All.

- Selective:

- If reivew/edit/update if performed in Flat View - click Toggle View to return to the default grouped view. Any changes made will apply.

- the default group view:

Click Assemble Invoice... The Document Details dialogue box will open.Anchor qa3 qa3

Note: The Assemble Invoice button will be disabled if the voyage is closed (on a TC Contract). To enable: re-open the voyage and assemble the invoice/s.

Example:- In the dialogue box, fill in the fields as follows:

- Enter a short description of the invoice under Document Text.

- Enter either

- the document date (if other than the default: today's date) under Document Date orDate

- or click the Triple Dot Selector next to the field. A pop-up with a calendar will openopens. Select date and click OK.

Example:

- Enter either

- the name of the payee under Issuing Company (if other than the automatically populated)

- or click the Triple Dot Selector next to the field. A pop-up with a list of input values will openopens. Select field and click OK.

Example:

- Enter either

- the bank account number the invoice is to be paid in to under Bank Account (if other than the automatically populated) or

- or click the Triple Dot Selector next to the field. A pop-up with a list of input values will openopens. Select field and click OK.

- Enter the invoice number of the received invoice (if applicable) under External Doc. No.

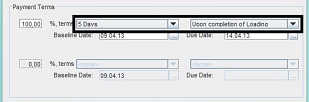

- In the Payment Terms field:

- Enter the payment percentage number in the % terms field (if other than the default: 100%).

- Select length of the payment term in the first drop-down menu and select the baseline term (i.e. from whence the payment term begins) in the second .

Example: - Enter either

- the baseline date (if other than the default: today's date) under Baseline Date

- or click the Triple Dot Selector next to the field. A pop-up with a calendar will openopens. Select date and click OK.

- Ensure that the date appearing in the the Due Date field corresponds with "the baseline date plus the length of the payment term".

- The lower payment and baseline terms fields are ONLY used in case of partial payment. If there is no partial payment - the lower % terms field will by default be 0% and the drop-down menus deactivated.

- Click OK. The dialogue box will close and the assembled invoice will move moves from Pending to the Assembled section.

Note: Any deselected invoice items will remain in the Pending section for later processing.

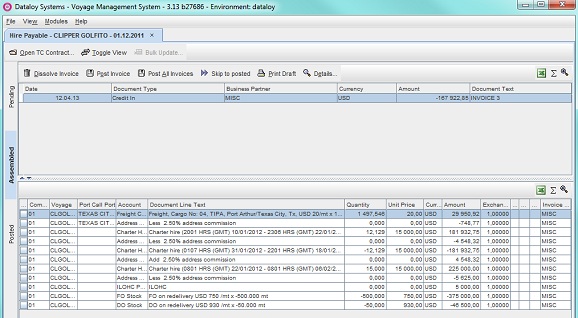

- Click Assembled at left-hand side. The Assembled view will open opens displaying all assembled invoices (i.e complete and ready for posting).

Example: - Click the invoice to be posted in the upper field - it will highlight.

- Click Details... to double-check the invoice details entered when assembling the invoice.

- The Document Details dialogue box will open. Review details and then click Close.

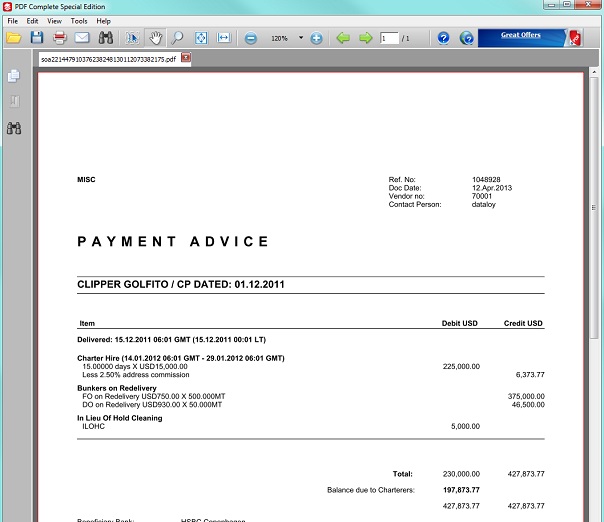

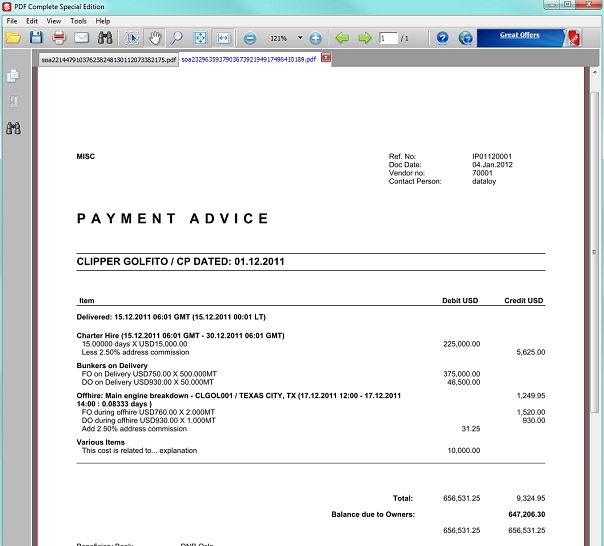

- Click Print Draft to print a draft invoice.

- An Invoice Print Options pop-up will open. Enter details (as applicable) and click OK.

- The pop-up will close and a draft payment advice will display as an electronic printout in PDF-format.

Note: The draft payment advice will look identical to when printing a posted invoice, but WITHOUT the DataloyVMS generated invoice number. This is generated when an invoice is posted.

Example: - Post an invoice/s either

- to an accounting system by selective - (selecting the invoices to be posted) or batch (posting all invoices) posting or

- Selective:

- Click the invoice row to be posted - it will highlight.

- Click Post Invoice. A pop-up will open opens asking to confirm move.

- Click OK. The pop-up will close and the selected invoice move to the Posted section with status Ready for Posting until sent to an accounting system. A Dataloy VMS invoice number will automatically generate for the invoice. Once the invoice is confirmed posted in the accounting system, the status will change to Posted.

- Batch:

- Click Post All Invoices to post all listed invoices - they will highlight.

- A pop-up will open opens asking to confirm move. Click OK. The pop-up will close and all invoices move to the Posted section with status Ready For Posting until sent to an accounting system. Dataloy VMS invoice numbers will automatically generate for the invoices. Once the invoices are confirmed posted in the accounting system, their status will change to Posted.

- Click Post All Invoices to post all listed invoices - they will highlight.

- Selective:

- or directly to the Posted folder (without being sent to an accounting system)

- Click the invoice row to be posted - it will highlight.

- Click Post Invocie. A pop-up will open opens asking to confirm move.

- Click OK. The pop-up will close and the selected invoice move to the Posted section with the permanent status Ready for Posting.

Note: Posting invoices manually requires the manual entry of each invoice into an accounting system. Also: Skip to posted is ONLY used when setting up an new system and there is a need to convert old, already posted invoices into the VMS. Status will immediately be set to posted. If used for new invoices, the invoices will remain with status "draft" and no proper invoice numbers will not be generated. In the accounting system the invoices will show without an invoice number. Re-posting will post the invoice to the accounting system using the draft invoice number.

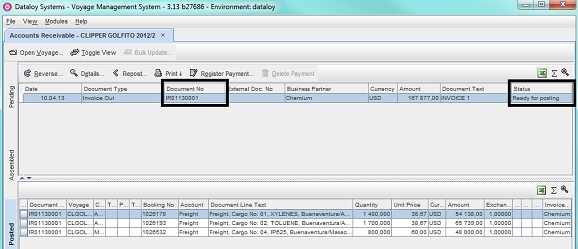

- Click Posted at left-hand side. The Posted view will open opens displaying all posted invoices (i.e. completed) with either status Ready for Posting or Posted. Invoices posted to an accounting system are identified by automatically genrated Dataloy VMS invoice numbers, each number unique per invoice.

Example: - Options available in the Posted section:

- To check Check invoice details:

- Click Details... to check the invoice details entered when assembling the invoice.

- The Document Details dialogue box will openopens. Review details and then click Close.

- To repost Repost an invoice if transfer to an acounting system fails:

- Click Repost to post the invoice again.

Note: This option normally requires Administrator or Super-User access rights. - A pop-up will appear appears asking to confirm posting. Click OK. The invoice will be reposted.

- Click Repost to post the invoice again.

- To manually Manually register payments:

- Click Register Payment... The Register Payment pop-up will open:opens.

Example: - Enter either

- the date (if other than the default: today's date) under Date

- or click the Triple Dot Selector next to the field. A pop-up with a calendar will openopens. Select date and click OK.

- Enter payment amount under Amount.

- Click OK. The pop-up will close and and the payment receipt will open opens as a row in the upper field in the Posted section.

Example:

- Click Register Payment... The Register Payment pop-up will open:opens.

- To manually delete Manually delete a registered payment:

- Click a payment receipt row in the upper field - it will highlight highlights and the Delete Payment button activate.

- Click Delete Payment. The payment receipt row till be deleted.

- To issue Issue invoice printouts and/or Statement of Accounts - go to Invoice Printouts/Statement of Accounts.

...

Dissolve/Reverse an Invoice

- To dissolve Dissolve an invoiceInvoice:

- Go to

Modules > Post Fixture > Hire Payable.The Hire Payable window will open. - Click Assembled at left-hand side. The Assembed view will open opens displaying all assembeld invoices (i.e complete and ready for posting).

- Click the invoice to be dissolved in the upper field - it will highlight.

- Click Dissolve Invoice. A pop-up will open opens asking to confirm dissolvement.

- Click OK. The pop-up vill will close and the invoice will revert to the Pending section.

- Go to

To reverse Reverse an invoiceInvoice:Anchor reverse reverse - Go to

Modules > Post Fixture > Hire Payable.The Hire Payable window will openopens. - Click Posted at left-hand side. The Posted view will open opens displaying all posted invoices.

- Click the invoice to be reversed in the upper field - it will highlight.

Note: It is NOT possible to reverse invoices that are payments, are linked to closed voyages (the voyages must first be re-opened) or have no document type (the Reverse... button will automatically deactivate). - Click Reverse. A pop-up will open opens asking to confirm reversal.

- Click Yes. The pop-up will close and an Input pop-up openopens.

- Enter the reason for the reversal and click OK.

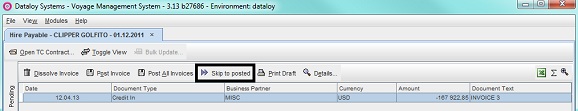

- The pop-up will close and a Credit In row will display displays in the upper field alongside the original invoice signifying that the invoice has been reversed.

Example:

- Go to

...

Partially Reverse an Offhire

Two methods are possible - changing the original entry (recommended) or reversing and posting a new.

- Partially reverse offhire Reverse Offhire by changeing Changeing the original entryOriginal Entry:

- Go to

Modules > Bookling and Operations > Offhire Browser.The Offhire Browser window will openopens. - Locate applicable vessel. It's details will display Its details displays in the lower field.

- In the Offhire Details tab either change

- the entered offhire satrt and end dates under Offhire Start Date and Offhire End Date

- or the number of days under Offhire Days

or the percentage under % (percentage).

- Go to

Modules > Post Fixture > Hire Payable.The Hire Payable window will openopens. - Open applicable voyage. The change will register registers as a cost under Pending.

- Changing offhire Offhire by full reversal Full Reversal and posting Posting a newNew:

- Go to

Modules > Post Fixture > Hire Payable.The Hire Payable window will openopens. - Click Posted at left-hand side. The Posted view will open opens displaying all posted invoices.

- Click the invoice to be reversed in the upper field - it will highlight.

- Click Reverse. A pop-up will open opens asking to confirm reversal.

- Click Yes. The pop-up will close and an Input pop-up open.

- Enter the reason for the reversal and click OK.

- Go to

Modules > Bookling and Operations > Offhire Browser.The Offhire Browser window will openopens. - Enter a new offhire where applicable in the Offhire Browser.

- Go to

Modules > Post Fixture > Hire Payable.The Hire Payable window will openopens. - Open applicable voyage. The reversed invoice will show as a cos cost to the user whilst the new a cost to the Owner.

- Go to

Invoice Printouts/Statement of Accounts

- To print Print an invoiceInvoice:

- Go to

Modules > Post Fixture > Accounts Receivable.The Accounts Receivable window will open. - Click Posted at left-hand side. The Posted view will open opens displaying all posted invoices.

- Click the invoice to be printed in the upper field - it will highlight.

- Click Print and from the drop-dowm menu select Select Transaction...

- An Invoice Print Options pop-up will openopens. Enter details (as applicable) and click OK.

- The pop-up will close and an invoice will display as an electronic printout in PDF-format including the automatically generated Dataloy VMS invoice number.

Example:

- Go to

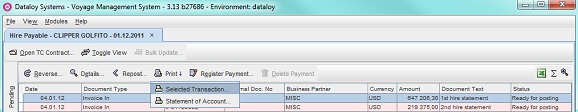

- To issue Issue and print a Print a Statement of Account:

- Go to

Modules > Post Fixture > Accounts Receivable.The Accounts Receivable window will openopens. - Click Posted at left-hand side. The Posted view will open opens displaying all posted invoices.

- Click Print and from the drop-down menu select Statement of Account...

- A Print Options pop-up will openopens. Enter details (as applicable) and click OK.

- The pop-up will close and a statement of account will display as an electronic printout in PDF-format.

Note: If a SoA is printed for a time charter (TC), the vessel redelivery time show under the delivery date - once the vessel is redelivered. Also, if the same time charter (TC) has been invoiced with two or more different invoice parties (or Owners) all invoiced items will show in the SoA with the present owner as business partner.

Example:

- Go to

...

| Expand | ||

|---|---|---|

| ||

|

...